The global economy is a dynamic system that experiences fluctuations in growth, employment, and overall economic activity. These cyclical patterns, known as economic cycles, are a natural part of the economic landscape. Understanding economic cycles is essential for governments, businesses, investors, and individuals alike, as they influence financial decisions, investment strategies, and policy-making. In this article, we will explore the concept of economic cycles, their different phases, and their impact on the overall economy.

Defining Economic Cycles:

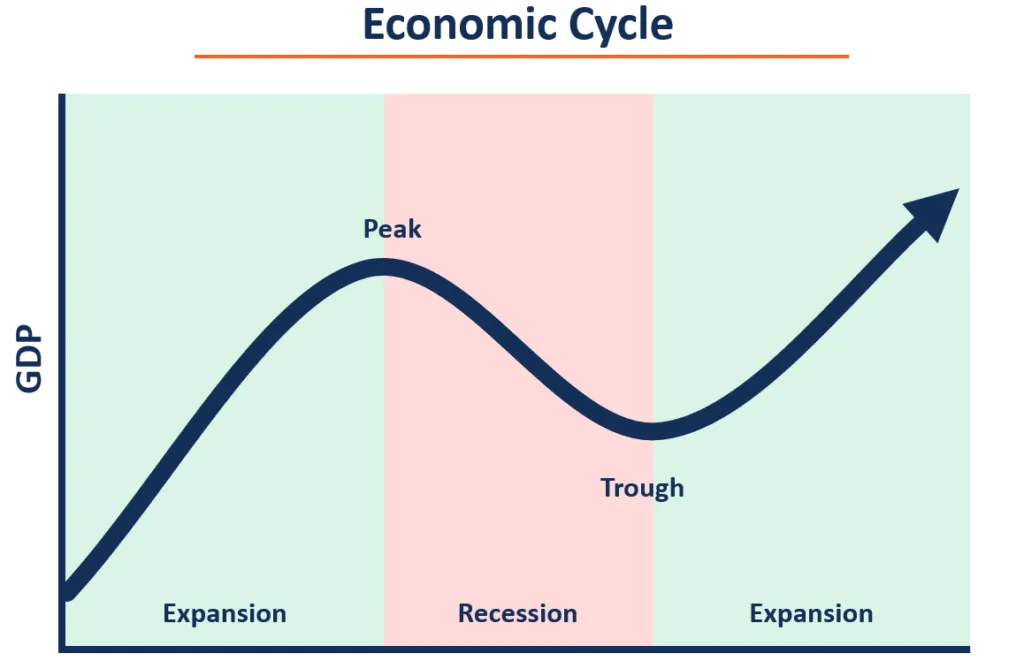

An economic cycle, also referred to as the business cycle, is the recurring pattern of expansion and contraction in economic activity over time. It is characterized by four main phases:

- Expansion: During the expansion phase, economic activity grows, and key indicators such as Gross Domestic Product (GDP), employment, and consumer spending increase. Businesses experience rising sales and profits, and overall optimism in the economy is high.

- Peak: The peak is the highest point of economic growth in the cycle. It marks the end of the expansion phase and the beginning of a slowdown. Economic indicators may start to show signs of deceleration, but the overall economy is still performing well.

- Contraction (Recession): In the contraction phase, economic activity declines. GDP contracts, unemployment rises, consumer spending decreases, and businesses face challenges, leading to reduced profits. A recession is typically defined as two consecutive quarters of negative GDP growth.

- Trough: The trough is the lowest point of the economic cycle. It marks the end of the recession phase and the beginning of a recovery. Economic indicators show signs of improvement, and the economy starts to grow again.

Causes and Drivers of Economic Cycles:

Economic cycles are influenced by various factors, including:

- Monetary Policy: Central banks use interest rates and monetary policies to control inflation and stimulate or slow down economic growth. Changes in interest rates impact borrowing, spending, and investment decisions.

- Fiscal Policy: Government spending, taxation, and fiscal policies can influence economic growth. Expansionary fiscal policies, such as increased government spending, may stimulate economic activity, while contractionary policies aim to reduce inflationary pressures.

- Business Investment: Business cycles are often driven by fluctuations in business investment. During expansion, businesses invest in growth and expansion, while during a contraction, they may cut back on investments and operations.

- Consumer Spending: Consumer confidence and spending habits play a significant role in shaping economic cycles. High consumer spending during expansions contributes to economic growth, while reduced spending during contractions can lead to recessions.

- External Factors: Economic cycles can be affected by global events, such as geopolitical tensions, international trade policies, and natural disasters.

Implications and Strategies for Economic Cycles:

- Investment Decisions: Investors should consider economic cycles when making investment decisions. Different asset classes may perform better in specific phases of the cycle, such as defensive stocks during recessions and growth-oriented stocks during expansions.

- Business Planning: Businesses should adjust their strategies and financial plans to account for economic cycles. Diversifying revenue streams, managing cash flow, and maintaining financial flexibility can help companies weather economic downturns.

- Policy-Making: Governments and central banks may use monetary and fiscal policies to counteract economic cycles. During recessions, expansionary policies can boost economic activity, while during expansions, policies to control inflation may be implemented.

- Risk Management: Understanding economic cycles is vital for risk management. Businesses and investors can assess potential vulnerabilities and adjust risk exposure accordingly.

Conclusion:

Economic cycles are an intrinsic aspect of the global economy, influencing prosperity and recession in a rhythmic pattern. By understanding these cycles and their drivers, individuals, businesses, and governments can make informed financial decisions, implement appropriate strategies, and effectively navigate the fluctuations of the economic landscape. Monitoring economic indicators, anticipating shifts in economic conditions, and adjusting financial plans accordingly can contribute to resilience and success in an ever-changing economic environment.